If you are anything like me, I thought of my credit score as the BoogieMan. I was so afraid of even thinking about seeing the report or getting my score. You see like millions of Americans I too have been late with credit card bills, bought one or two or 100 useless expensive items that I do not own anymore, but am still paying off. Sound familiar? Oh and I cannot forget to mention to you that my credit card rampage started at age 18 as a freshman at UCLA when the halls and common areas would be full of credit card company representatives luring me to sign up for a card and due to these memories , I have prepared the following for you:

Oh and I cannot forget to mention to you that my credit card rampage started at age 18 as a freshman at UCLA when the halls and common areas would be full of credit card company representatives luring me to sign up for a card and due to these memories , I have prepared the following for you:

Top 6 Stupid Reasons People (A.K.A Adriana) Get/Got Credit Cards:

- The credit card offers the design of your favorite professional sports team

- The credit card with the tie-dye look or Hello Kitty Kat is too cute to say no!

- The credit card company is giving away a free beach towel, or frisbee, or hackey sack.

- You are at the JETs game and they will give you a “Limited Edition” rowdy towel if you sign-up now!

- You just need $500 worth of Victoria Secrete panties….like NOW!

- Because you can walk away today with your 60inch flat screen TV to play Battle Field3 or watch Entourage and not own anything for a year……

And all of our favorite saying: Charrrrrrge it!

Yes people I fell for those traps too! Hey the beach towel and T-shirt came in handy when you go to school in southern California and you do not like doing laundry.

My credit score used to be so bad I was unable to get my own cell phone service in my name, was rejected for a Macy’s credit card and the only cards I could get were the ones with a security deposit on them. So my years as a credit card owning woman have been many and well nothing to be too proud of, but today because of what I am going to share with you I have managed to rebound my credit in as little as 2 years to score higher than 60% of Americans, nothing to brag about, but sure better than it was before. Before I share a few tips on how to improve your credit score, let me debunk a few myths.

1. I Do Not Need To Know My Credit Score – FALSE

If you one day want to own a car, house or a couch to put in that house, you will most likely need to have good to excellent credit, therefore knowing what your score is now is important and should not be ignored

2. Credit Cards Are Bad – FALSE

Your parents may have told you this one before, but the truth is all wealthy people typically only buy using a credit card.

3. You Should Make Big Purchases in Cash – Not Exactly

There are several reasons why you would want to, if you have the available credit, to buy something using a credit card rather than cash. For one, if paid on time and complete, it can boost your credit score. Secondly a lot of credit card companies offer separate warranties on purchase made with their cards.

4. I Filled Bankruptcy, I Will Never Have Good Credit – FALSE.

Let’s just say this, Credit Card companies make money and are “successful”, when there are more people who default on their payments. They love having people in debt. After 7 years it is cleared from your report.So here is how to fix your credit score.

Ok so now here are something’s I did to improve my score:

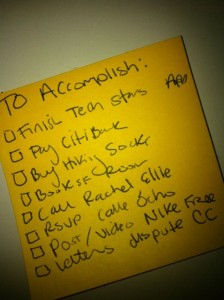

1. Make a List of all Your Credit Cards

Provide this information, I use an excel sheet to track, highest credit limit, years it has been opened, balance due, and APR.

Now that you have this list, make the credit card that has the highest credit limit and has been opened for the longest amount of time be your most important card. Do that until you have somewhat of a ranking. Then;

2. Always, Always Make Your Payments On Time.

Short on cash? Having a tough month financially? Whatever it is, I am sure I have been there before, but always prioritize your monthly credit card bill to be paid and pay it on time. 355 of your credit report score is On Time Payments, this is a huge chunk of scoring high or low. So put the new LV purse or Air Nikes on hold, pay your credit cards first.

Only TWO things You Need To Do??

Ummm not that easy! But it is doable and I and a few friends of mine are proof!

I am not a credit expert, but these are just a few simple things I did to help improve my credit score within a short amount of time. Nothing can be done overnight, but by simply doing this I do promise your score can improve. Without good credit you can not and DO NOT have any buying power in America.

Do you want to eventually own your own home?

Buy a car?

Not have to get a cosigner for your cellphone?

Ummm maybe want to have furniture that is bought and owned and not by a rent-a-center???

Then your credit score needs a “facelift”?

Hey Everyone Needs An Extra Friend! Connect with me on FACEBOOK.

No Comments